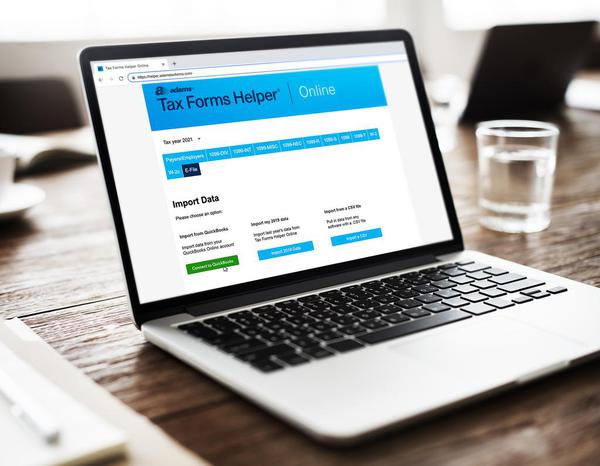

Adams Tax Forms

This new integration between Tax Forms Helper Online and QuickBooks® Online will simplify tax time.

writer | copywriter | journalist

A selection of landing page content and knowledge base articles for Adams Tax Forms.

Search-engine-optimized e-content for leading national brands.

A sampling of ads, sell sheets, and flyers for B2B clients and consumers.

I’m a copywriter based in St. Louis, MO.

An early background in journalism provides me with the chops for rigorous research and adroit storytelling.

As a writer and researcher, it’s my job to peel away the obvious and lay bare unspoken motivation.

To take complex ideas and distill them into clear, crisp copy.

To wrestle with words and win.

Together, I’m sure we can produce great work that gets noticed and gets results.

Let’s work together.

All the best,

Fontella

My inbox is always open. I'd love to hear from you.